Rates are a tax on the value of your property. Rates provide around half of council’s income and this money pays for new roads, stormwater systems, libraries, water pipes, parks and reserves and so on.

In the 2025/26 financial year, council plans to spend approximately $591 million in operational expenditure, most of which is used to deliver the services the city needs day-to-day. A further $425 million is planned to be spent on capital works – long term investments like building new facilities and infrastructure.

Of the operational costs, $368 million is funded from rates which are collected from 58,345 residential customers, 2513 commercial customers and 1474 industrial customers.

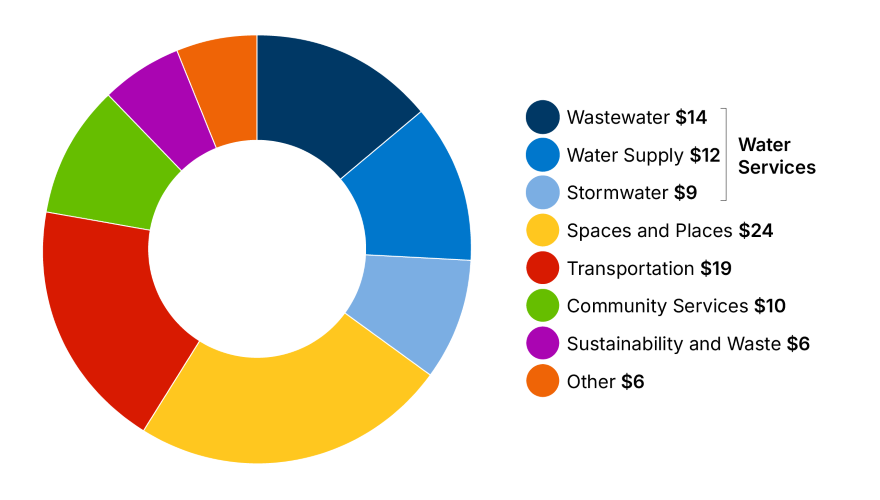

Rates breakdown 2025/26

What do your rates pay for? For every $100 of rates

My Rates August 2025 (497kb pdf)

How rates are set

Rates are calculated using the property value and the use of the property, such as residential, commercial or rural. Council’s Annual Plan or Long-term Plan decides the work for the year ahead, how much this will cost and the total amount of rates that are needed to pay for it.

The value of your property is set by independent valuers, Opteon. Revaluations are done every three years. The most recent citywide revaluation was done on 1 May 2023 and has been used to calculate the rates from 1 July 2025.

Where council income comes from:

Council’s total income includes both operational income ($532m) and asset development revenue ($106m) for a total of $638m. This revenue comes from:

- Rates: 58% of revenue

- User fees: 12% of revenue

- Development contributions: 4% of revenue

- Grants and subsidies, and other capital contributions from the government and others: 22% of revenue

- Interest and other revenue: 4% of revenue

Tauranga City Council no longer collects rates on behalf of Bay of Plenty Regional Council. For information on regional rates go to www.boprc.govt.nz/rates